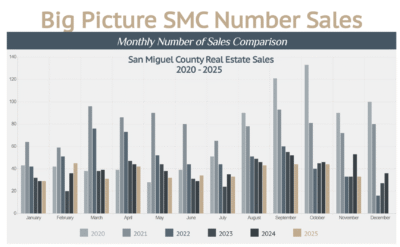

San Miguel County’s November 2025 performance reflects a market returning to a more sustainable transactional pace after several volatile years.

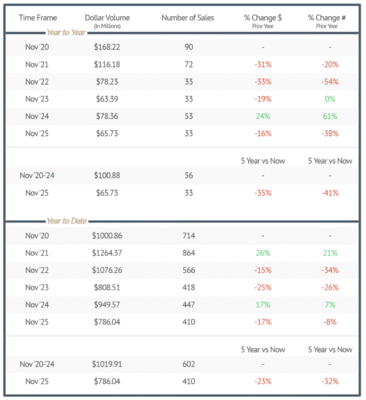

November sales totaled 33 transactions and $65.73M in volume, representing a 16% decline in dollar volume and a 38% decline in units compared to November 2024. The five-year comparison underscores that broader recalibration: dollar volume sits 35% below the 2020-2024 November

average, and the number of sales is down 41%. Yet several sectors-particularly deed-restricted and mid-range condominium product-continue to trade steadily, helping maintain a more balanced absorption rate than in other resort counties experiencing sharper slowdowns.

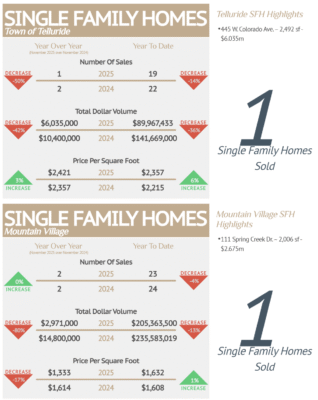

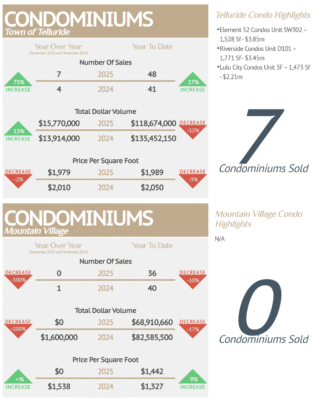

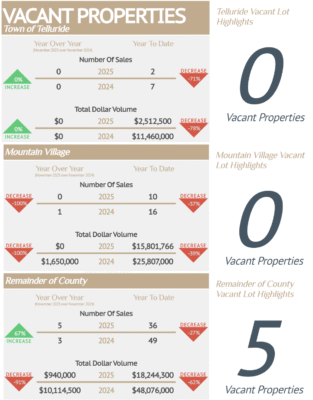

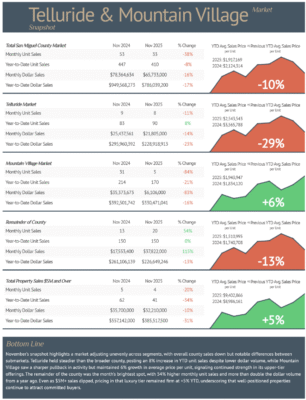

Looking at the 2025 YTD data, San Miguel County’s performance continues to be driven by the two primary resort submarkets-Telluride and Mountain Village-which together account for the majority of the county’s high-value transactions. Telluride’s condominium/half-duplex segment closed 49 transactions totaling $119.95M YTD, with major production months including $21.64M in September and $15.77M in November, reinforcing this category as the town’s most consistently active market driver. Mountain Village’s condominium/half-duplex sector recorded 35 YTD transactions for $66.66M, highlighted by strong periods such as $12.45M in April, $9.51M in May, and $9.71M in October. Across both communities, single-family home activity also delivered meaningful impact-Telluride at $89.97M across 19 closings, and Mountain Village at $205.27M across 22 closings- underscoring that upper-tier buyers remain engaged even as overall transaction velocity moderates. These figures illustrate that although unit counts are down from peak-cycle years, premium-location, premium-quality properties continue to command robust pricing and remain the core engine of San Miquel County’s resort-area market.

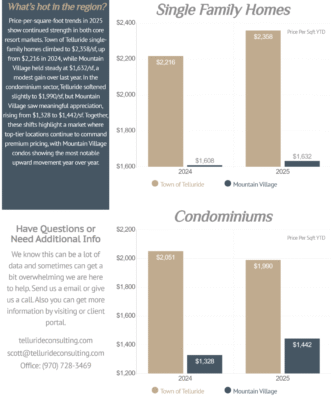

Relative to other luxury destinations-Aspen/Snowmass, Jackson Hole, Sun Valley, and Vail-Telluride’s 2025 performance reflects the same broader market reset driven by limited inventory, higher borrowing costs, and more deliberate buyers. San Miguel County continues to stand out, however, with steady high-end condo and single-family activity in both Telluride and Mountain Village and comparatively less price softening than many peer resorts. The persistence of multi-million-dollar closings shows that lifestyle buyers remain engaged, particularly for updated or turnkey properties. As winter demand builds, the market enters December with a smaller but stronger buyer pool, firm Luxury pricing, and transaction levels that remain competitive within the Rocky Mountain resort landscape.

November ’25 San Miguel County Real Estate Market Sales Report

San Miguel County’s November 2025